- #Extra payment mortgage calculator with amortization how to#

- #Extra payment mortgage calculator with amortization update#

- #Extra payment mortgage calculator with amortization free#

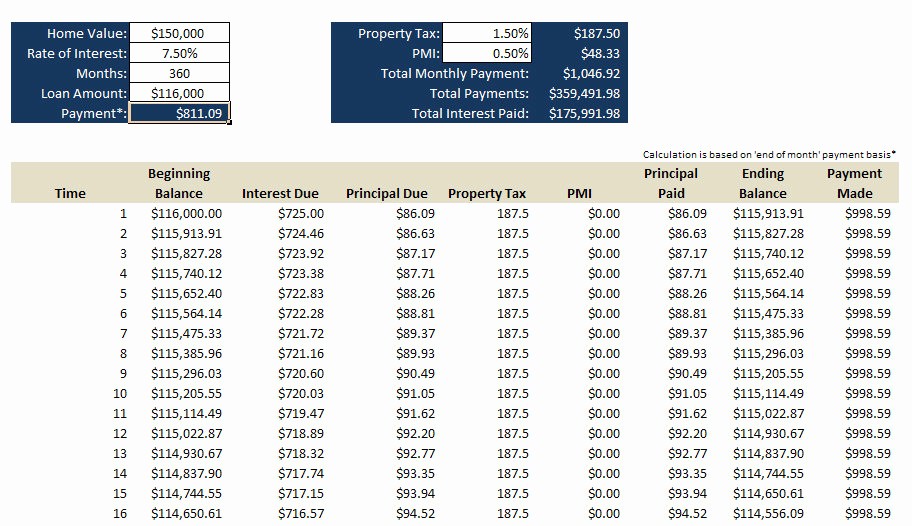

While this display table also shows you the total principal and interest paid in each year of the mortgage and your remaining principal balance at the end of each calendar year, clicking the "+" sign next to a year reveals a month-by-month breakdown of your costs.

This display shows you the total principal and interest paid in each year of the mortgage and your remaining principal balance at the end of each calendar year. This display shows the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date. If you don't yet have a mortgage, the current month and year will work just fine. To get the most accurate calculations, use the month and year in which your very first mortgage payment was due (or will be due). Fixed rate mortgages are most often found in 30, 20, 15 and 10-year terms Adjustable Rate Mortgages usually have total terms of 30 years, but the fixed interest rate period is much shorter than that, lasting from 1 to 10 years. To see where rates are right now, click on the "See today's average rates" link to the right of the field, where you can also find offers from our advertising partners. Along with the term, this is the key factor used by the mortgage payment calculator to determine what your monthly payment will be.

#Extra payment mortgage calculator with amortization update#

(Hitting "tab" after entering information in any field will automatically update the calculations.) This is the dollar amount of the mortgage you are borrowing.

#Extra payment mortgage calculator with amortization free#

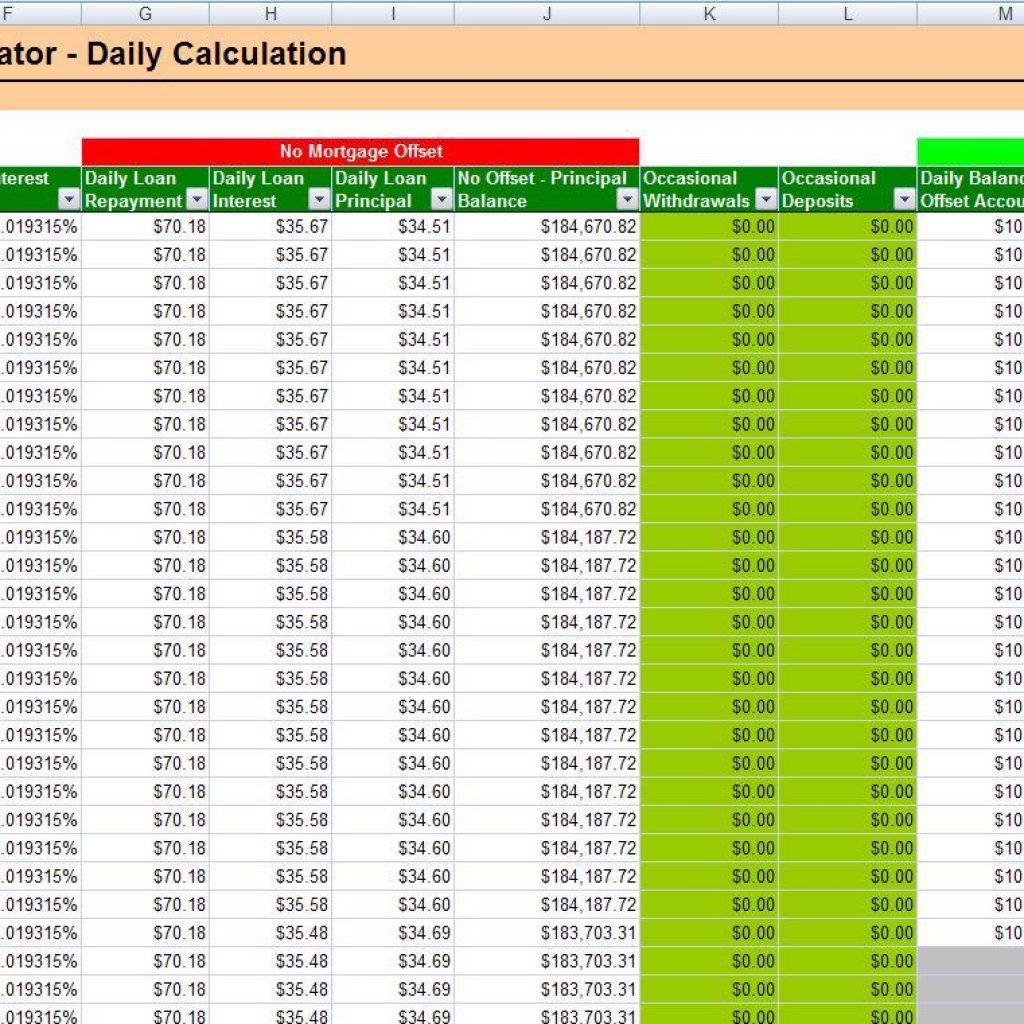

HSH.com has developed a host of other free mortgage calculators to help answer your other questions, such as, "Can I qualify for a mortgage," "Will prepaying my mortgage help me save money," "How large of a down payment do I really need," "What’s the best way to pay for my refinance," and "When will my home no longer be underwater?" See all of HSH.com's mortgage calculators. Of course you'll want to consult with your financial advisor about whether it's best to prepay your mortgage or put that money toward something else, such as retirement. You may also target a certain loan term or monthly payment by using our mortgage prepayment calculator. Using the $250,000 example above, enter "50" in the monthly principal prepayment field, then either hit "tab" or scroll down to click "calculate." Initial results will be displayed under "Payment details," and you can see further details in either the "Payment chart" or "Amortization schedule" tabs. Let's say, for example, you want to pay an extra $50 a month. The calculator allows you to enter a monthly, annual, bi-weekly or one-time amount for additional principal prepayment.To do so, click "+ Prepayment options." Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. Clicking the "+" sign next to a year reveals a month-by-month breakdown of your costs.Ĭlick "calculate" to get your monthly payment amount and an amortization schedule. To see this, click on "Payment chart" and mouse over any year.Ĭlicking on "Amortization schedule" reveals a display table of the total principal and interest paid in each year of the mortgage and your remaining principal balance at the end of each calendar year. For instance, in the first year of a 30-year, $250,000 mortgage with a fixed 5% interest rate, $12,416.24 of your payments goes toward interest, and only $3,688.41 goes towards your principal. Most of your mortgage loan payment will go toward interest in the early years of the loan, with a growing amount going toward the loan principal as the years go by - until finally almost all of your payment goes toward principal at the end. Your initial display will show you the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date. With HSH.com's mortgage payment calculator, you enter the features of your mortgage: amount of the principal loan balance, the interest rate, the home loan term, and the month and year the loan begins.

#Extra payment mortgage calculator with amortization how to#

How to use the loan amortization calculator The loan calculator also lets you see how much you can save by prepaying some of the principal. A mortgage amortization calculator shows how much of your monthly mortgage payment will go toward principal and interest over the life of your loan.

0 kommentar(er)

0 kommentar(er)